The next society we visit on

our journey is called ‘Equal Price/ leasehold payment leasehold ownership.’ In

this society, the landlords of the world are willing to allow private property,

by allowing people to lease parts of the planet from them under these terms:

people who want to control property privately must take a class and pass a test

to confirm they understand how private property works before they can even

register to bid on rights to control parts of the planet privately. They are

taught that the human race does allow people to own property rights, but not freehold property rights. In other

words, they can’t own parts of the planet itself, they can only own the

permission of the landlords of the world (the human race) to use parts of

planets in certain ways and in accordance with certain rules the landlords have

made to protect the rights of the landlords of the world.

In order to buy rights to the world, they must bid in auctions to show

that they place more value on these rights (and are willing to pay the

landlords of the world more to get them) than anyone else on Earth is willing

to pay. They must be willing to pay two ways:

1.

By paying a price for the leasehold document itself and,

2.

By agreeing to make a leasehold payment over time to their landlords.

In the class, people are taught that the landlords of the world have

decided that they want a great deal of security to guarantee that leasehold

owners are responsible. In order to make sure that leasehold owners will be

responsible, the landlords of the world will require an initial investment

(called the ‘price’ of the leasehold title) that is equal to the amount that will be promised to the human race

each year as a leasehold payment.

This is a kind of hybrid system between a natural law society with pure

rental and a sovereign law society with freehold ownership. In the class,

people are taught that they can think of this kind of leasehold ownership either as an extreme kind of rental or as an extreme form of ‘regular’

ownership, with a very high ‘property tax.’

If they want to think of it as a rental, they could say that it is a

rental with a huge deposit, a

deposit that is equal to the

yearly rent. They could think of the auction as a bid for this rental: whoever

bids the highest amount to rent each property, knowing in advance that they

will have to post a ‘deposit’ equal to the amount they bid, will win the auction.

For example, if Kathy is willing to offer $2 million a year as a yearly payment

to the landlords (which she could think of as ‘rent’ if she wants) she must also be willing to offer $2 million as a

‘deposit’ on the property. She will ‘post this deposit’ when she signs the

rental agreement; she can get it back at any time (by ‘selling the leasehold

back to the landlords’) provided she is current on her ‘rent’ and providing she

has followed the other rules of her rental agreement (mainly not using the property in ways that are on

the ‘list of potentially harmful uses’).

If they want to think of it as an extreme form of ‘regular ownership,’

they could say that they are bidding to buy the

property, under terms that will create a yearly ‘property tax’ obligation (the

leasehold payment) that is exactly equal to the price they pay. For example, if

Kathy is willing to offer a price of $2 million a year, she will be aware that

by offering this price she will create an obligation to make a yearly payment

to her landlords for the same $2 million.

Although we can think of

this system either way (as a rental with a very high deposit or regular

ownership with a very high property tax), it is technically not either of these

things. Technically, it is a leasehold ownership system, with a price/leasehold

payment ratio equal to 1:1. In other words, it is a leasehold system where

people who bid to buy the leasehold must also bid to make a leasehold payment

equal to the price they pay.

The

Bidding

The EPLPLO system is based on the premise that the human race is the

dominant species of being on the planet Earth. We are in charge and make the

rules. We can make any rules we want and no other being on the planet can

override them. In this particular case, we have decided that we want an

enormous amount of security to guarantee our yearly leasehold payment, so we

have set the price of the leasehold equal to the yearly leasehold payment bid.

In the auction, we will allow people to bid on the leasehold. They will

have to bid in an electronic auction that has a bid screen like this:

Auction

for the Leasehold ownership Rights to the Pastland Farm:

You

must enter a number into both boxes to bid. The number you enter in to the

‘leasehold payment’ box must be exactly the same as the number you enter into

the ‘price’ box to register the bid.

Your

PRICE offer [$

]

Your

LEASEHOLD PAYMENT offer [$ ]

IMPORTANT:

You must enter numbers into both boxes above to activate the bid now button.

The number you enter in to the ‘leasehold payment’ box must be exactly 100%

times the number you enter into the ‘price’ box to register the bid.

[Bid

Now]

When we arrive in this society, we are looking in at a private meeting:

Kathy and Sally are getting together a few days before the auction is

set to open. Sally is working for the investors, who will provide the money

that will be transferred to the sellers of the leasehold (the landlords of the

Earth, the human race in this case) as a ‘price.’ Sally is a financial expert

and understands all of the numbers.

As always, Kathy just wants to be a farmer. She is meeting with Sally

to help her understand how to make this happen (how to become a farmer in this system). Kathy

points out that she is willing to farm the land if she can make the $50,000 she

needs for the work she does, after all of

the costs and expenses (including

any payments she must make to either investors or landlords). Kathy

knows that the farm is bountiful and produces a free cash flow of $2.4 million

a year. She can afford to pay out $2.4 million a year (the entire free cash

flow) as a total mortgage payment; she can’t

afford to pay more than

this.

Kathy has seen the bid screen.

She tells Sally that she is very confused, because it doesn’t have a

place for her to offer a ‘total mortgage payment.’ She can only put down a

‘price’ and a ‘leasehold payment,’ these numbers will determine her total mortgage payment.

Kathy tells Sally that she needs to know what numbers to put into the boxes to

make sure her total payment is affordable. Sally sits down at her computer and

a few minutes later a sheet of paper Kathy’s phone buzzes to confirm she has

received an email from Sally that contains an attachment called a ‘cheat

sheet.’ Sally explains that Kathy can use this to show her how much her total

mortgage payment will be if she bids different numbers. The columns are color

coded, with the first column (in blue) representing amounts she might put into

the ‘price’ box, the yellow column the amounts she must enter into the

‘leasehold payment’ box at each different ‘price’ entered, the red column

showing her interest payment to investors at each different price offer, and

the green column at the end her total mortgage payment at each combination of

numbers.

|

Cheat Sheet for equal

price/leasehold payment leasehold ownership

|

|

Price (amount borrowed)

|

Leasehold payment (equal to

price)

|

Interest on mortgage loan

|

Total mortgage payment

including interest and leasehold payment

|

|

$ 100

|

$ 100

|

$ 4

|

$ 104

|

|

$ 1,000

|

$ 1,000

|

$ 40

|

$ 1,040

|

|

$ 10,000

|

$ 10,000

|

$ 400

|

$ 10,400

|

|

$ 100,000

|

$ 100,000

|

$ 4,000

|

$ 104,000

|

|

$ 1,000,000

|

$ 1,000,000

|

$ 40,000

|

$ 1,040,000

|

|

$ 1,400,000

|

$ 1,400,000

|

$ 56,000

|

$ 1,456,000

|

|

$ 1,800,000

|

$ 1,800,000

|

$ 72,000

|

$ 1,872,000

|

|

$ 2,000,000

|

$ 2,000,000

|

$ 80,000

|

$ 2,080,000

|

|

$ 2,200,000

|

$ 2,200,000

|

$ 88,000

|

$ 2,288,000

|

|

$ 2,225,000

|

$ 2,225,000

|

$ 89,000

|

$ 2,314,000

|

|

$ 2,250,000

|

$ 2,250,000

|

$ 90,000

|

$ 2,340,000

|

|

$ 2,301,978

|

$ 2,301,978

|

$ 92,079

|

$ 2,394,057

|

|

$ 2,307,678

|

$ 2,307,678

|

$ 92,307

|

$ 2,399,985

|

|

$ 2,307,691

|

$ 2,307,691

|

$ 92,308

|

$ 2,399,999

|

|

$ 2,307,692

|

$ 2,307,692

|

$ 92,308

|

$ 2,400,000

|

|

$ 2,307,693

|

$ 2,307,693

|

$ 92,308

|

$ 2,400,001

|

|

$ 2,307,703

|

$ 2,307,703

|

$ 92,308

|

$ 2,400,011

|

|

$ 2,307,778

|

$ 2,307,778

|

$ 92,311

|

$ 2,400,089

|

|

$ 2,300,000

|

$ 2,300,000

|

$ 92,000

|

$ 2,392,000

|

Sally prepared the cheat sheet so that Kathy, would know what happens

if she makes various bids. Sally knows that the leasehold will sell for

whatever price/leasehold payment combination makes the total mortgage payment

exactly equal to the free cash flow. She has highlighted the appropriate

numbers on the spreadsheet so Kathy will know what numbers she can bid to make

this happen.

When she gives Kathy the spreadsheet, she points her to the last

column, which indicates her total yearly payment on the property. Sally calls

this the ‘mortgage payment’ and shows that it includes both the amount she has

promised to pay the human race and the amount she has promised to pay Sally

(which she calls the ‘interest on the mortgage loan’). Kathy has already

pointed out that she can afford a total cost of owning the leasehold rights (a

total mortgage payment) of $2.4 million a year. To help her find the right

numbers, Sally has highlighted the appropriate numbers on the spreadsheet.

Sally has highlighted one row, starting with a price of $2,307,692. If

she wants to bid this price, she must also enter a leasehold payment bid of

$2,307,692 (exactly equal to the price bid). At this price, her interest to the

investors will be $92,308 a year. Add this to the leasehold payment to get a

total mortgage payment of exactly $2.4 million a year.

Sally says that this is the exact maximum that Kathy can bid. If she

can win the bidding for less than this, her total mortgage payment will be less

than $2.4 million a year. (Note that all of the total mortgage payments in the

columns above the highlighted bid

are lower than $2.4 million.) If

she bids this exact amount and wins, her total mortgage payment will be the

maximum she can afford. If she bids more than

$2,307,692 and wins, her total mortgage payment will be higher than the $2.4 million maximum she

can afford. Since she won’t be able to afford this payment, she will probably

wind up losing the property and going bankrupt (perhaps leading to lawsuits and

claims against her personal property). She could therefore not bid anything higher than $2,307,692.

Technical

Details

Sally also points out that the investors want to make absolutely sure

that the leasehold payment gets made, so they will require that Kathy make only

one payment, to Sally, who represents the investors. Sally must collect the

full amount due everyone from Kathy. For example, if Kathy’s total interest

payment plus her leasehold payment is $2.4 million a year, Kathy must pay this

entire amount to Sally. Sally will then take the money that belongs to the

human race ($2,307,692 of this) and put it into an ‘escrow account.’ This money

will then be used to make the leasehold payment to the landlords when it is

due. Sally will then turn over the interest to the investors.

Kathy won’t have to worry about this. The investors will make it very

simple for her: she will have to make one payment,

of exactly $2.4 million a year, to the bank that ‘services’ the loan on behalf

of the investors. The investors will be paying the bank a yearly fee to then

make sure that this money gets to the people who are supposed to get it. For

example, if Kathy wins at her exact maximum bid (which will happen, as you will

see), the bank will separate the $2.4 million it gets into two payments, one of

$2,307,692 which will go to the landlords as their leasehold payments, the

other will be $93,208 and will go to the investors.

The

Auction

Let’s simplify this auction so we don’t have to go over things we

already understand from previous auctions. We know that at least two people are

willing to enter the exact same bids, that will lead to a total mortgage

payment of $2.4 million a year. Kathy wants to have the greatest chance of

winning, so she isn’t going to start with a low bid and risk someone bidding

her maximum and outbidding her, offering a figure that Kathy can tie but not

beat. To prevent this, Kathy is going to enter her maximum bid the instant the

auction opens. Then, she will either win or not win. She won’t have to stress

out about the bidding process, she can turn off her computer and go fishing.

When she gets back, she will either have won or not won. As soon as the bidding

opens, she enters her maximum bid and the computer lists her as the highest

bidder.

Here is the way she has filled out the bid form:

Auction

for the Leasehold ownership Rights to the Pastland Farm:

You

must enter a number into both boxes to bid. The number you enter in to the

‘leasehold payment’ box must be exactly 100% times the number you enter into

the ‘price’ box to register the bid.

Your

PRICE offer [$2,307,692]

Your

LEASEHOLD PAYMENT offer [$2,307,692]

IMPORTANT:

You must enter numbers into both boxes above to activate the bid now button.

The number you enter in to the ‘leasehold payment’ box must be exactly 100%

times the number you enter into the ‘price’ box to register the bid.

[Bid Now]

The auction lasts 90 days. Kathy goes on an extended vacation, away

from anywhere her computer can bother her. When she comes back she logs on and

finds she has won.

I

need a simple term to refer to a leasehold ownership system where the price and

leasehold payment are equal, so I don’t have to refer to this over and over. I

will call this ‘equal price/leasehold payment leasehold ownership.’ I need a

name to refer to societies built on this form of property control. I will call

such societies EPLPLO societies.

Documents

The investors require that people who borrow money to buy leaseholds

sign certain documents that indicate they understand their responsibilities to

the investors. The investors require the buyers/borrowers to sign these

documents before the investors

will ‘disburse funds,’ which basically means they need the documents before they give up any of their money.

Kathy will go to a ‘closing’ (similar to the ‘closings’ that people

have to go through to buy property rights in our 21st century societies) where

she will go over the documents and sign them. Kathy is aware of this: she has

already taken the class on leasehold ownership, which went over all of the

documents she may be asked to sign at the closing.

The first document she must sign is the leasehold agreement with her

landlords, the members of the human race. The landlords are willing to allow

Kathy to have special rights to this property: she can control it as private

property and use it in any way that is not on

the ‘list of potentially harmful uses.’ In exchange for granting Kathy these

rights, the landlords are requiring Kathy to make a leasehold payment to the

treasurer of the human race equal to exactly $2,307,692 a year. The leasehold

agreement goes over this and several details of her agreement with the members

of the human race. Kathy studied this agreement in her class, learned why her

landlords put in each provision and what it meant. She already understands and

has agreed to these terms. (This must be true: she knew from her class she

would have to sign this document and, if she weren’t

willing to sign it, she wouldn’t have

bothered to bid.) Kathy signs the document and Sally, who is ‘closing’ the deal

on behalf of the investors, puts it in a pile she is starting for ‘signed

documents’ so she can keep track of it.

Kathy must then sign her mortgage document, which stipulates all the

details of her agreement with the investors.

Her landlords don’t

require her to actually farm the land. (She owns the right to use the land for

anything she wants, provided it is not on the ‘list of potentially harmful

uses.’)

But the investors do require

that she farms the land: They need to know that Kathy will be able to afford to

make her yearly total mortgage payment, because they want to make absolutely

sure the money will be there, when the time comes, to pay them (and pay the

landlords). The investors have long and detailed agreement which goes over

everything Kathy must do in order to satisfy the investors.

For example, they require her

to use the land to raise rice. She can’t use it for any other purpose without first getting the written consent

of the investors. The agreement not only says that Kathy must use the farm this

way, it says how she must do it: she must operate the property as a rice farm,

in a ‘businesslike manner,’ in accordance with the ‘highest standards of

professionalism.’ The investors have hired people to check up on their

investments and make sure the purchasers and owners of leaseholds are complying

with the terms of the agreement. If the investigators find that Kathy is not

complying, they will send her a letter ordering her to bring herself into

compliance; if she doesn’t, they can take the farm away from her (repossess it)

using procedures explained in the mortgage agreement.

Kathy signs a number of other documents dealing with various details.

The escrow officer at the closing puts the signed documents into a pile. After

Kathy signs all of the documents, the escrow officer gives her a certified

check for $2,307,692 which is made out to ‘Kathy and the treasurer of the human

race.’ The check is made out to both parties, so that both parties must sign it

before it can be cashed. The escrow officer at the closing gives it to Kathy to

countersign and puts it with the papers that will go to the ‘treasurer of the

human race.’ As soon as the treasurer signs acknowledging the receipt of the check,

the deal has ‘closed’ and is done. Kathy is the new owner of the leasehold

title to the Pastland Farm.

New

Incentives

Kathy runs the farm just as she always has. She makes all the same

decisions, hires all the same people, negotiates worker pay and supply costs

the same way so she presumably pays the same amount to run the farm. She runs

the farm the same way as always so it produces the same as always. She ‘sells’

total production of 3.5 million pounds of rice like always (trades it for

money) and gets $3.15 million. She uses $700,000 of this to pay her cash costs

like always.

In the earlier systems, she paid another $2.4 million to the human

race. This time, she pays this exact same amount of money each year, but this

money doesn’t go the landlords anymore: It goes to the ‘servicer’ of the loan.

The servicer gives $2,307,692 of this money to the landlords as their leasehold

payment, and gives the rest of the money to the investors as their returns on

wealth.

Kathy cares a great deal about the amount

she pays, but she doesn’t really care about what happens to this

money after she pays it. In this case, she pays the same amount she paid

before.

Although her situation may seem the same as it was before, it isn’t

exactly the same. You see, she has actually paid a very high ‘price’ for the

leasehold. (She paid with borrowed money, but she still paid it.)

The price depends on the free cash flow; if she improves the farm so

the free cash flow is higher, the price can go higher. In fact, it is now high enough,

and can go up by enough from improvements, to cover the cost of simple

improvements. In the earlier systems, we saw that the price would not go up by enough from improvements to cover the cost

of the improvements. As a result, Kathy would have lost money if she had purchased the leasehold, improved the

property, and then sold the leasehold on the property. Now, for the very first

time, she will not lose money if

she buys, improves, and then sells. (I will go over the numbers below so you

can see them.)

In the systems we will visit later, she will actually be able to make money buying, improving, and then

selling. In some of these systems, she will be able to make millions of dollars buying,

improving, and selling. But here, we are in a transaction system, one where the

realities of societies change. The earlier systems did not have incentives to

buy, improve, and then sell; this is the first

system we get to where people who improve are not penalized

for this by having to put up with a financial loss to make the world a better

place.

On our journey through possible societies, we have seen only societies without incentives to buy leaseholds on

properties, improve the underlying properties, and sell the leaseholds. If

people respond to incentives, we would expect all of the societies so far to be

stagnant. They would not change for incredibly long periods of time. Now, there

are some people who may be motivated to improve. We may see some changes,

improvements, progress, and growth.

The incentives to buy, improve, and then sell is one of the two things about society that

will change with the EPLPLO system. The other involves a transfer of risk from

the human race to investors. In the systems before

EPLPLO system, the price was lower

than the leasehold payment. The price is the amount of money the

investors will lose if the

leasehold payment is not paid on time. In the earlier systems, they would

actually lose less money by not

making the leasehold payment than they would lose if they did make the leasehold payment. They had

incentives to not make the

leasehold payment (to keep the

money Kathy pays as a leasehold payment rather than turning it over to the

landlords of the planet, the members of the human race; see sidebar for more

information.)

For

example:

In ‘virtual rental leasehold ownership’ the leasehold to the Pastland

Farm sold for 24¢ with a leasehold payment of $2.4 million a year. If the

leasehold payment is missed, whoever put up the 24¢ will lose it. But say you

have $2.4 million in your hands that you are supposed

to pay to another party, but know that all you will lose if you don’t pay it is 24¢. You have incentives to keep the $2.4 million, and

give up the 24¢.

In this case the leasehold payment is $2,307,692 and the price is $2,307,692. If you are

holding $2,307,692 that you are supposed to pay to a third party, and know you

will lose $2,307,692 if you don’t pay the $2,307,692, you do not have incentives to keep this money. In

all the societies we visit later, people lose more money if they don’t pay than

if they do, so they have incentives to pay rather than keep the money. This is

the first society that they do not have incentives to keep the money.

Risk

When the deal closed, the landlords of the world actually got a

certified check for $2,307,692. The landlords are holding this money, but it

isn’t really our money, because Kathy has the right to sell the leasehold back

to us and we are required to buy it back, provided she is in compliance with

the leasehold agreement for this amount. As long as there is a chance that we will have to buy back this

leasehold, we have to hold the $2,307,692 that is committed to buying it back

(this is the exact price we must pay if we buy it back) in a reserve account.

This is not our money, and it isn’t really Kathy’s money. It is a kind

of protection money: it represents reserves that private individuals (the

investors) have accumulated over time. The investors can only get returns on

these reserves if they agree to make these reserves common reserves, by investing in this loan, so they have

agreed to do this. This money represents the common reserves of the human race,

available to protect us in case something bad happens.

The investors know this. They will know that, if something bad happens,

they can lose their money. To make sure that they don’t lose their money, they

will want to find ways to make sure bad things don’t happen. They aren’t going

to guess about ways to do this, they will hire professionals, as described

below, and use the best risk management techniques available. If they do a good

job at this, they will be able to prevent anything major from going wrong, and

have reserves (described below) to make sure the leasehold payment can be made

even if something does go wrong, so the human race will never be affected by

any problems at the farm. If the investors do a good job, the reserves in the

‘reserve account of the human race’ will never

actually have to be used to

protect the human race, and will stay in the reserve account for as long as the

human race wants the property to be private.

In all of the earlier societies

we visited, it was possible that

the human race may not get the

full leasehold payment that has been promised to us. While we did have some

reserves, we did not have enough reserves to replace the full leasehold

payment. (The price was lower than the leasehold payment; the price is the

money the human race holds in reserve.) Now, for the very first time in our

journey, it is no longer possible for the human race to not get its full

leasehold payment as promised and when promised. We will either get the leasehold payment we have

been promised of $2,307,692 or we

will get the property back and be able to transfer the $2,307,692 in the

reserve account into our working account. From this point forward, the

landlords (members of the human race) will not be taking on any risk.

When there is no possible way an income stream can not come in, it is

called a ‘risk-free’ income stream. The income of the human race in the EPLPLO

society is now a ‘risk-free income.’

Risk

Management

All farming is risky. Things can go wrong. If our entire group isn’t

taking on the risk, that doesn’t change the risky nature of farming. Someone

else must take on risk. In this case, the investors are taking on risk. They

have put up $2,307,692 at risk. As long as the landlords of the planet get our

promised leasehold payment, the investors know their money is safe. In fact,

they will all make very nice returns on their investment. Kathy will be happy

because she will be able to keep doing what she loves to do and get paid for

it; the investors will be happy because they will get their promised returns,

and the human race as a whole will be happy because we will share in the bounty

of the land without having to do anything.

Note:

We only get protection for one year’s worth of leasehold payment in the EPLPLO

system. If a event like a hurricane causes serious damage to the land, we may

not get as much when we sell the leasehold ownership rights the second time so

we may lose. In the leasehold ownership systems discussed below, we will get

more than one year’s protection. We will, of course, have to give up a little

bit in current income to get the greater security. We, the landlords of the

planet, can decide how we want private property to work and make it work that

way. If we want more security and less income, we can have it, as you will see.

The professional investors are taking on this risk. If something goes

wrong, they will lose money.

Sally, the person who organized the investment pool and deals with the

investors, knows about the risk.

Sally was a professional risk manager at a bank back in the United

States before she took this trip and she knows that farming investments are

risky. Things can go wrong. Back in the future, she took steps to manage risk

so that, if she could help it, nothing would go wrong. Here in Pastland, she

will put the exact same skills to work for the same reason: She wants to make

sure nothing goes wrong so she will keep getting her money. Her interests (to

reduce her risk of not getting her money to the lowest level possible) match

our interests (to get our share of the bounty of the world no matter what

happens).

As long as nothing goes wrong, everyone will be happy.

Sally started managing risk before the auction even took place. Several

people approached her for a loan so that they could buy the leasehold title on

the Pastland Farm. She required them to submit very detailed applications. She

wouldn’t loan money to people with no farming experience, because they are too

risky. She wouldn’t loan money to people who had a bad credit profile (they had

bought on credit and not paid their bills) for the same reason. She wouldn’t

loan money to people in bad health or people who had gambling or drug problems.

She only approved people she knew would be good risks. Kathy qualified for the

loan and got a loan commitment because she was known to be a good farmer, a

responsible borrower, and able and willing to meet the commitments she was

making.

Sally managed risk when she wrote up the lending agreement that Kathy

had to sign to get the loan. The agreement required Kathy to run the farm in a

‘businesslike manner’ (all farm lending agreements have a clause like this) and

failure to do so would be a violation of the agreement. Sally had the right to

watch Kathy to make sure she did a good job on the farm. If Kathy wasn’t doing

a good job, the lending agreement allowed Sally to step in and take over. Sally

didn’t expect this to happen, but it was possible and she wanted to make sure

she had the right to take over if necessary. The lending agreement required

that Sally get a ‘lien’ on the harvest money. When she sold the crop, the check

would be made out in both women’s names, and both would have to sign to cash

it. The lending agreement required that the entire mortgage payment be made the

same day that the check was cashed, so Kathy had to make sure Sally got the

full amount she was promised before she got a dime herself.

Back in the United States, Sally had been a risk manager at an

agricultural bank in Texas that specialized in mortgage loans to farm buyers.

She will take the same steps to manage risk here in Pastland that she took back

in the United States. She will watch the farm and the weather. She will keep a

rolodex of people who do certain things so she will have people to call in case

of an emergency. If it looks like there will be a flood, Sally will call Kathy

and ask if she has a crew ready to make sandbags to keep the crop safe. If not,

Sally will offer to round up people for this. If Kathy can’t afford the

sandbaggers, Sally will offer to loan Kathy the money to pay them, to make sure

the harvest is safe. If Kathy won’t agree to the loan, Sally will evoke the

clause that allows her to take over (not protecting the crop is not

‘businesslike) and make sure the crop is safe.

Sally knows that, with good risk management practices, rice farms

produce very consistent yields. However, sometimes there are problems no matter

how carefully people manage risk. Back in the United States, she kept a ‘loan

loss reserve fund’ to deal with these issues. She put about half of her yearly

interest into this account, to use in the event the mortgage payment was

missed. Here in Pastland, she will do the same thing. She will build up an

account and fund it with half of her yearly interest. If something major goes

wrong, in spite of her best efforts, she will step in as rapidly as she can and

manage the loss to keep it as small as possible. If there is enough to make the

leasehold payment, she will make it. If not, she will use as much of production

as she can to make as much of the leasehold payment as she can, and take the

rest out of her ‘loss reserve fund.’ She will make absolutely sure the human

race gets paid because, if we are not paid, Sally loses everything.

Perhaps something truly major, a catastrophe, will come along that

leaves her without enough money from production and the reserve fund to pay the

leasehold payment. If this happens, she will use other savings to make up the

difference. If she doesn’t have enough savings, she will borrow it from anyone

in Pastland that has anything to borrow. She will do this to avoid missing the

leasehold payment, knowing she will lose $2,285,714 if she misses it. If she

can’t borrow enough, she will sell anything she owns to get this money. If

there is any way to get the money to make the leasehold payment, she will find

it and we will get our money.

I want to point out that we aren’t involved in any of these activities

in any way. It is entirely up to Kathy and Sally to make sure everything goes

smoothly. We don’t involve ourselves because we can’t lose no matter what.

Kathy and Sally will do anything they have to do to make sure we get ours and

we can expect them to succeed because they are both professionals who know what

they are doing. But even if they fail, we can’t lose. We already have

$2,285,714 and are holding it in reserve. If worst comes to worst, both Sally

and Kathy may be totally broke, but we won’t lose a single dime of our income

from this land. Even a catastrophe won’t affect us—the human race as a whole—in

any way.

Improvements

This land is in the same condition as it was in when nature made it.

Only the owner of land has any right to alter it. When we first arrived her,

people started arguing over who owned the land. As time passed, these arguments

got more and more heated and eventually they threatened to turn violent. We

wanted to stop the fighting (or at least put it off until some time in the future

when we would be better able to deal with it) so we put the moratorium into

effect. During the moratorium period, no one could own, claim to own, or even

suggest the land may possibly be ownable. To suggest that we had the right to

alter it was to suggest that the land is ownable (only the owners can alter

land) so to even suggest an alteration violated the moratorium.

Nature made this marsh fairly level, but not perfectly level. There are

high spots that stick up out of the water in the summer; the rice on these

spots withers and dies. There are low spots where the water is so deep that the

plants can’t reach the sun and don’t produce any rice at all. From the very

first, Kathy knew that the farm could produce more with level land. While the

moratorium was in effect, she had some private conversations with her friends

about suggesting improvements. While they generally supported her, they said

that some of the members of our group appeared to be true believers in natural

law and would interpret any suggestion about modifying the land to be a

violation of the moratorium. She thought about it and eventually decided not to

say anything.

We ended the moratorium a few years ago and could talk about

ownability. She brought up the topic at a meeting. She said that this land was

really our land, meaning the land of the human race, and we have the right to

improve it if we want to do this. Many people agreed with her. As soon as she

brought up the topic, they started explaining their ideas about the best way to

improve the land.

Natural law societies are not hierarchical societies and no one’s

opinion has greater weight than anyone else’s opinion. Kathy thought people

would listen to her because she was a professional rice farmer with a great

deal of experience. But a few other people are professionals in other fields

and believe that their ideas are just as valid as Kathy’s. For example, one of

our people is a karmic audiologist. Before we went on this trip, he was the

foremost man in this field, and did research on sounds that would help solve

problems. Wealthy people from all over the world hired him—for enormous sums of

money—to find the sounds that would help sooth them, cure their phobias,

improve their artistic qualities, or help them with their other problems. He

says that plants respond very well to the proper sounds, and particularly to

the sound of human voices. He says he talked to his garden back in the United

States and always had a far better garden than neighbors who didn’t talk to

their plants. He has several studies on his laptop that prove that plants have

feelings and react to love.

He has been telling them they are loved all along, but his voice is not

enough. He suggests we organize ourselves into teams so we can keep telling the

rice plants how loved they are 24 hours a day. If we do this, the land will

produce more and we will all have more for ourselves, and better lives.

Another of our members believes in a group of gods who he claims

determine plant growth rates. If we don’t get good yields from the low-lying

areas, this is because we haven’t prayed enough to the gods that determine

growth rates in these areas. He suggests we organize prayer vigils to get the

favor of the gods. Another person has been an aroma therapist his entire life. He

says plants grow better if exposed to certain smells. He advocates opening a

research facility to determine which smells have the best effect and then

finding way to produce those smells. Another specializes in past-life

regression. He says we need to regress the rice to its previous lives and deal

with the trauma they felt in those lives. Once we release them they will be

happy and grow better, giving the yields we want without having to go to the

trouble of leveling the land.

We have a chemist who says we need to grind up rocks to add minerals to

the land. When we replenish the minerals, the plant growth rate will increase.

A geneticist that says we need to modify the DNA. A lot of people have a lot of

different ideas.

The natural law society highly values social harmony. Kathy has to get

along with these people. If she starts fighting with others to try to get them

to back down and accept her land-leveling project, she will make people angry.

She secretly believes that most of these people are just nuts who have no idea

what they are talking about, and most of their ideas will not have any material

effect on the yields. But she knows she will get along with people a lot better

if she doesn’t express her opinion openly. She can’t really push too hard on her

land-leveling project without having to tell these people why they need to back

off, so she doesn’t really want to push too hard.

She also has practical reasons to not push too hard for change. If she

should get us to agree to the leveling project, she can expect us to ask her to

draw up the plan on her own time. Then, she will have to present the plan to

the group and justify it to the group. She will have to come up with estimates

of the required work and find some way to get people to agree to do the work,

or do it herself. She can expect that if she doesn’t show up for work, no one

else will do anything. She will have to organize everything. She will have to

set the pace, meaning she will have to work at least as hard as she wants

everyone else to work. If people don’t show up or goof off, she will have to be

the autocrat that gets them back on track. If something goes wrong, she will be

expected to find a solution to it and get it back on track. If the entire

project is a failure—for any reason, even if it is beyond her control—she can

expect to be blamed. Even if everything works out perfectly, something

unrelated may go wrong, lie a drought or an insect infestation, and many people

will claim that it wouldn’t have happened if we hadn’t upset the natural order,

and blame her for the weather or insects. Even if absolutely nothing goes wrong

and production goes up as she expects, she will get only 1/1000th of the

increase (in the natural law society) and this won’t increase her personal

income enough to compensate for all of the hardship she will have to go through

to make the change work. After she thinks about these things, she decides it

might be a good idea to back someone else’s plan so she doesn’t even have to

worry about being asked to carry through on her leveling project.

I have some experience in this kind of situation. I live on a commune

in the woods of Oregon. Because of the stigma of the word ‘commune,’ it is

officially called a ‘club.’ Right after I moved there I tried to get a change

through. Our swimming pool was heated with propane, and we spent $1,000 a month

on fuel to heat it. I have a background in solar and knew we could put up a

solar system for a small amount of money that would cut the heating cost to

nothing most of the year, and keep it lower the rest of the year. At a general

meeting, I brought this idea up. I was actually surprised no one had brought it

up before, it seemed so obvious.

I found that others had brought it up. It had been mentioned many times

and it had provoked many arguments. One group of people had come out as the

voice of reason, claiming that people who were in favor of solar were

unrealistic idealists who only wanted to spend (other people’s) money on

unproven ideas in order to assuage their guilt. The ‘realists’ had done a

complete cost analysis and shown that a solar system that would provide 100% of

the year-around heat for the pool would cost $40,000. We wouldn’t be able to

meet the club’s maintenance needs if we stripped the budget for this totally

unnecessary project. I was told about all of the absolutely ‘vital’ projects

that had to be completed immediately with the funds we had, or the club

wouldn’t be able to function anymore. If my project were approved, all of the

buildings would fall down, the swimming pool would slide into the field below

it, and the world as we know it would end. I would be to blame for all of this.

Then I got all of the arguments against solar. Solar panels are ugly.

Why am I advocating uglying up the club? The solar system would require

maintenance and no one here is qualified to do it. We would have to get experts

at sky-high rates for this. (Unless I was willing to agree to maintain it on my

own time and at my own expense forever.) It would have pipes that would have to

run over the ground, and deer could trip over the pipes and break their legs.

The birds would get fried when they landed on the solar panels. All of these

arguments came at me and I stood alone and confused answering them.

I later found that these same people had presented the same arguments

many times before, because the issue had been brought up many times before.

(The club had been in existence since 1949). They felt that they had ‘won’

these arguments because the solar-proponents had always dropped their case in

the past. To them, ‘winning’ meant ‘getting the other side to back down,’ not

‘saving $10,000 a year on heating bills.’

They wanted to win.

The issues weren’t the issue. They were in positions of authority and

people listened to them. Their credibility was at stake. They had been against

solar 30 years ago and felt they had to continue to be against it, no matter

how much technology had changed, or people wouldn’t respect them anymore. It

wasn’t about efficiency, improvements, or cutting costs, it was about

personalities and respect. This experience taught me something about proposing

change in a communal living situation: The easy course is always to oppose change of any kind. This leaves you

clear of blame and, as long as you can prevent change, you can never be proven

wrong. Once you have come out against change,

you obviously have to stick with this position in the future. The proponents of

change will have to fight every inch of the way or nothing will ever get done.

This may help you see why millions of natural law societies could go

for millions of years without making any material changes in their living

situation: Even if people who wanted change could overcome the religious and

philosophical objections to the change (like that the creator of the universe

owns it and will punish us if we change it), and can get over the social

hurdles, chances are you won’t be able to overcome the practical resistance to

the idea of change in general.

The basic problem boils down to incentives: If Kathy pushes hard enough

and eventually gets the change made, she knows she will have to do the

lion-share of the work, take on the lion-share of the responsibility, and pay

more than an equal share of the costs, but she will only get 1/1000th of the

benefits. To each individual, the cost of just about any permanent change that

they hope will lead to improvements will exceed the benefits. People have

incentives to avoid behaviors that bring less in benefits to them than their

costs, so people have incentives to resist change in progress in any natural

law society.

For millions of years, humans lived in natural law societies. These

people appear to have been no different than people in current societies. But

we didn’t see any progress or investment in improvements for virtually this

entire time. If you consider the incentives, you should have some idea why this

happened: the incentive structure pushed very strongly to against activities

that would have led to progress and growth.

Improvement

In Equal Price/Leasehold Payment Leasehold Ownership

Now, in the EPLPLO society, things are entirely different.

All ownership-accepting societies are hierarchical societies. Kathy

owns rights to the world and this gives her a different set of rights over it

than the rest of the people of society. She no longer has to ask us for

permission to level the land. She owns the right to do anything that doesn’t

harm the land. Leveling the land is not on the ‘list of harmful acts’ so she

has purchased and owns the right to level the land.

She doesn’t have to get anyone’s permission before she makes

modifications to this land, because she owns the right to modify the land. If

she wants to level the land, she hire people tomorrow to start moving dirt.

There are two basic ways to make money improving:

The first option is to invest in improvements that drive up the free

cash flow and collect the higher free cash flows. However, most of the money

people make from improving in current systems has a different source: they buy

unimproved properties for a low price, improve to drive up the free cash flows,

and then sell the improved properties for a much higher price than they paid.

This generates a gain called a ‘capital gain’ on the improvement. Since most of

the money people make from improving and selling for the gain, most if the

incentives come from this source.

People will be able to make money both ways in the EPLPLO system. To

fully understand the incentives, we need to understand both options. The

easiest way I can think of to explain this involves coming up with some numbers

for the sake of example.

Improvements

to the Pastland Farm

Kathy starts by hiring someone to make a survey of her land and draw it

up on a map with contour lines. (These lines are lines that show the height of

various parts of the land.) She then hires an engineer and sits down with her

to work out the best way to build the walls. The engineer has been trained in

this field. She knows how to calculate the number of lineal feet of wall that

will be needed with each plan and therefore the cost of each project. The

engineer finds the lowest-cost method of leveling the land, draws up the plan,

and submits it to Kathy for approval. Kathy suggests some minor changes that

she needs in order to get equipment from terrace to terrace during the harvest

and the engineer finalizes the plan. After she has a finalized plan, she goes

to some people who know how to build rock walls and move dirt and gets bids on

the project.

I need some numbers to explain the example so let’s say that she gets

total bids for the entire project of $461,538.

Then she works out the projected yield of the leveled farm and figures

out how much both the total revenues, total costs, and free cash flow will go

up if she makes this change. Let’s say that she finds that yield on the farm

will go up by 20%. This will make the revenues 20% higher. She will have to pay

more money each year to harvest the extra rice, so she figures her costs will

also go up by 20% a year.

|

|

before

|

after

|

|

Revenues

|

$3,150,000

|

$3,780,000

|

|

Costs

|

$750,000

|

$900,000

|

|

free cash flow

|

$2,400,000

|

$2,880,000

|

So far, this is what she has: (see table to right).

Both revenues and costs go up by 20%, so the free cash flow must also

go up by 20%. Her leasehold payment will remain the same at $2,307,692 a year.

She will have to borrow $1 million to pay for the improvement, leading to

another $40,000 a year in interest, in addition to her current $92,308 in

interest, making her new total interest payment $132,308 a year.

|

|

before

|

after

|

|

Revenues

|

$3,150,000

|

$3,780,000

|

|

Production costs

|

$700,000

|

$840,000

|

|

Interest

|

$92,308

|

$132,308

|

|

leasehold payment

|

$2,307,692

|

$2,307,692

|

|

Money to Kathy

|

$50,000

|

$500,000

|

The table to the right shows how everything works out:

Notice the bottom line: If she makes this improvement with totally

borrowed money, her personal income from the farm goes up by a factor of 10

times, from $50,000 to $500,000. Remember, this is not taking a single penny

out of her own pocket, and without having to do a bit of the work. I hope you

can see that she will make a great deal of money making this improvement.

But there is one problem we haven’t talked about yet. If she puts $1

million into this property, she will owe $1 million more money on it than she

owes now. She will be responsible for paying back this money. She needs to know

that she will be able to get her money back, when she sells, or she probably

won’t be willing to make this improvement. To find out, she calls a property

appraiser and has an appraisal done to determine what will happen to the price

of the leasehold if she improves. (She will probably need to do this to get the

loan. The banker will have to know that the collateral will be worth at least

as much as she owes on it.)

The appraiser points out that the prices of leaseholds depend entirely

on the free cash flow. If the free cash flow of the property goes up by 20%,

the market value of the leasehold will also go up by 20%.

|

|

Before

|

after

|

increase

|

|

free cash flow

|

$2,400,000

|

$2,880,000

|

|

|

leasehold payment

|

$2,307,692

|

$2,769,231

|

|

|

Price

|

$2,307,692

|

$2,769,231

|

$461,538

|

|

interest on debt

|

$92,308

|

$110,769

|

|

|

cost of owning the

leasehold

|

$2,400,000

|

$2,880,000

|

|

The appraiser explains how and why this happens with a table showing

the costs and benefits of owning the leasehold at both free cash flows. People

will keep bidding as long as they can keep free money, after paying their total

costs of owning the leasehold. (In other words, they pay out all of the free

money either to the human race or to investors, leaving them with only the

amounts they need to justify the work.) The first column shows what Kathy paid

and why the market set that particular price: Other bidders were greedy. They

wanted free money. As long as the costs of owning the leasehold were less than

the free cash flow, they got free money. They kept bidding until the bids got

so high that, after paying the leasehold payment and interest, they had none of

the free cash flow left.

If the free cash flow goes up by 20%, all of the numbers go up by 20%,

including the price. As you can see, the price is $461,538 higher.

In the systems we look at later, the prices of leaseholds will be a

great deal higher and the increases in prices due to improvements will be a

great deal higher. But here we can see that the price increase is just high

enough to justify this particular improvement. Kathy can show the banker that

the property price will go up by the amount of extra money she will borrow to

pay for the improvement, so the collateral will be worth at least as much as

she owes on the loan. This satisfies Sally that she will have security on the

loan. Kathy will be able to get enough money back from the sale (when she

sells) to repay the original loan plus the improvement loan, so she will not

have to worry about possibly losing money if she is forced to sell for some

reason. She will not take any money out of her own pocket to make this

improvement, but her income will go up from $50,000 to $500,000 a year, clearly

a huge increase.

People have incentives to improve if they can make money improving.

Here Kathy will make a huge increase in her yearly income, so she clearly has

incentives to improve. In many of the systems we will look at later, she will

also make a multi-million dollar ‘capital gain’ on the sale. Here, she doesn’t

make any gain at all, but she does at least break even on the ‘capital’ side of

the investment. Everything is either ‘break even’ or positive, so she has no

reason not to make the improvement and powerful incentives to make it.

Improvements

in Different Societies

We, the members of the human race, can decide what is more important to

us, the price or the leasehold payment.

We are the landlords of the Earth. We make the rules. We decide whether

people will be able to hold private property and, if so, what conditions they

must meet to hold private property. If we want to, we can allow people to

obtain rights to private property for a one-time simple fee called the ‘price,’

with nothing again ever to the human race. If we want, we may decide to let

people hold private property with payments made over time to the landlords of

the world (rents), and no ‘price’ at all. We may also decide to choose

intermediate options, that require a payment of both a price and yearly

leasehold payment to the landlords of the world.

If we choose an intermediate system, we must decide how important we

want the ‘price’ to be and how important we want the yearly payment to the

human race to be. We may want higher prices for

leaseholds (accepting, in return, lower leasehold payments) if we want people

to have stronger incentives to manage risk, protect the human race from harm or

shortages in production, and to improve the world so it creates a higher bounty for

the benefit of future generations.

The higher price creates stronger incentives

to manage risk because it gives the people who control property (and their

investor/backers) more of something investors call ‘skin in the game.’ They

have to invest more and therefore

can get ‘hurt’ more if something goes wrong. If you have ever invested money

and then lost it, you will know that this hurts: I have felt real pain after

losing large sums in projects that didn’t work out. (Many people feel so much

pain at investment losses that they kill themselves rather than continue to

bear it. My grandfather was one of thousands of people who killed themselves

immediately after the market crash of October 1929 wiped them out financially.)

If they invest more money (pay higher prices

for properties) they have more ‘skin in the game’ and more to lose

if something goes wrong. If we, the landlords of the world, want people to have

more ‘skin in the game,’ more to lose if something goes wrong, and stronger

incentives to manage risk, we can set up a leasehold ownership system that has

prices that are higher relative to leasehold payments. (In other words, the

price/leasehold payment ratio is higher, as in systems lower in the Road Map of Possible

Societies.)

To see how this will make a difference in

the way people think, compare the virtual rental leasehold ownership system

with the EPLPLO system. In virtual rental, Kathy would pay a price of 24¢ for

the leasehold, and would have 24¢ at risk. If she misses the leasehold payment,

she will lose 100% of the price. You might imagine, however, that Kathy

wouldn’t lose much sleep at the possibility of losing 24¢. If she makes the

payment; fine. If not, well she will lose so little money it won’t make any

difference in her disposition. However, in the EPLPLO system, she will lose more

than $2 million. Not many people can lose more than $2 million in a day without

feeling some real pain. She will have a lot more skin in the game in the EPLPLO

system than in the virtual rental system, so we would expect her to work harder

and try harder to make sure nothing goes wrong. (In the systems that follow,

buyers and owners of leaseholds will have even more skin in the game, and far

stronger incentives to manage risk.)

We, the members of the human race, decide

what we care about.

If we want the highest possible leasehold

payments, we will have to choose leasehold ownership systems that lead to very

low prices. (In other words, choose leasehold ownership systems with very low

price/leasehold payment ratios, or those higher

in the Road Map of Possible Societies.) In these systems, the buyers

won’t have much skin in the game and may not give us anything at all. If we

want the people who interact with the land on a day-to-day basis to have more

skin in the game, and more to lose if something goes wrong, we will have to

accept lower leasehold payments in exchange. In this case, we get only about

96% of the total free cash flow (the amount we would get in a pure rental

system).

Higher prices are also important for

incentives to improve. If the free cash flow goes up by 20%, the price of the

leasehold goes up by 20%. If the price starts out at 24¢, the 20% increase is

only about 5¢. This is not enough money to cause Kathy to lose any sleep

looking for ways to improve the property. If the price starts out at $2.3

million, the 20% increase is $460,000. A lot of people would lose sleep at

night, thinking about ways to improve property, if they knew they would make

$460,000 on the project.

We don’t get these wonderful incentives for free. We must give up something:

we must give up part of the current income

we could get from the property if we want incentives to protect the human race

from risk and improve the world to make it better. But we—meaning our group in

Pastland who have accepted that we are

the dominant species on the world (rather than some invisible Superbeing in the

sky that has created ‘nations’ and given nations ownership of land)—are in a

position to decide what we want to happen in our world. We can come to

understand the different options. Once we understand them all, we can decide

what is important to us (strong incentives to protect the human race from risk or a higher current income), find the

system that matches our priorities, and create it.

Incentives

in Different Societies

The chart to the right shows the amount of gain people can make from an

improvement that increases the free cash flow by 20% in various different

leasehold ownership systems.

If Kathy wants to get the land leveled, she will have to pay people to

do the work. This will cost her something. Let’s say, for the sake of example,

that it will cost her $461,538.

In the virtual rental leasehold ownership system (the first one), she bought

the leasehold rights for a price of 24¢. If this goes up by 20%, it only goes

up by 5¢. This won’t be enough to cover the cost of making the improvements.

She will lose money on the entire

project (buying the leasehold rights, improving the property, and then selling

the leasehold rights). In fact, she will lose virtually everything she pays for

improvements.

The first society where she doesn’t lose money on this project is the

EPLPLO system. Even there, she doesn’t make money,

she only breaks even. Perhaps she may want to improve the land for some reason

other than her capital gain. (For example, perhaps others have doubted her

capabilities and she wants to show them they are wrong, or perhaps she sees

that the population is growing and wants to show people that food production

can also increase.) In the earlier systems (those before EPLPLO) she would have

a hard time justifying this improvement: only very rich people can afford to lose massive amounts of money to make the

world a better place.

In all systems after EPLPLO,

she won’t have to justify anything: her interests coincide with the interests

of the human race: we want growing production to feed our growing population,

and Kathy wants to get rich, something she can do by improving the world.

EPLPLO systems are transitional systems: In these systems, for the

first time, people can at least break even on improvement projects. This is the

first society where the interests

of the people who control property don’t conflict

with the needs of the human race. It is the first society where people who are

not punished for making the world

a better place.

A

Transitional Society

In our journey through possible societies, we started out in a range

that looks pretty much the same. All societies above the EPLPLO system are very

similar in many respects. The EPLPLO society is one of three transitional

societies. It is the first place where constructive incentives appear. After

this, the constructive incentives will get stronger and stronger until they

reach their maximum, at the socratic leasehold ownership societies. Socratic

leasehold ownership societies are the second transitional system we will reach.

When we get there, the constructive incentives will be as strong as they can

possibly be, but the system won’t yet have any destructive incentives.

All societies below socratic

leasehold ownership will have destructive incentives that grow ever stronger,

and constructive incentives that grow ever weaker as we go through the range.

This will continue until the constructive incentives and destructive incentives

are the same strength: at that point, we will reach our final transitional

society, systems that have the minimum conditions needed for sustainability,

and therefore the minimum conditions needed for survival for the human race.

I call this third transitional society ‘minimally sustainable

societies.’ All societies below the

minimally sustainable societies are suicidal: any people who decide they want

to keep any society inside this range (rather than working to push it into the

sustainable range) are doomed, and will perish with absolute certainty, given

enough time.

The EPLPLO system is the first transitional society. At this point, the

realities of societies change in three major ways:

1.

All societies above the EPLPLO society expose the human race to some risk.

If people don’t invest as least as

much money as they are agreeing to pay the human race, they don’t have enough

skin in the game to ensure they will protect the interests of the human race.

All societies above EPLPLO societies don’t require people to put enough skin in

the game, so they expose the human race to risk. All societies below EPLPLO

societies force people to put so much skin in the game that they will be hurt

more (imagine the skin being scraped off) if they don’t protect the interests of the human race than if the do protect the interests of the human

race.

In

EPLPLO systems, people must put up exactly enough money to replace the

leasehold payment if it is missed. This causes the incentives to make a sudden

transition: It is no longer possible to profit by harming the human race by

shorting us or cheating us out of our share of the bounty of the world. It also

provides an amount in the ‘reserve account of the human race’ that will exactly

replace the leasehold payment if it is missed, meaning that we have total

income security (at least for the next year) starting at this exact spot.

In the earlier systems, the members of the human race had cause to

worry: the people who interacted with the land may possibly be bad managers, be

dishonest, incompetent, or otherwise have come characteristic that prevents

them from providing the food and other necessities we care about. From this

point forward, we can all sleep soundly at night, knowing that we will either get our leasehold payment this

year, or we will get the property

back and get the amount in the

reserve account, which is exactly the same as the promised leasehold payment.

At this point, the risks of

production are transferred to profit-motivated, skilled, professional risk

managers, not the members of the

human race.

2.

The second transition involves responsibility.

In every society, someone or

some group must take on the responsibility of making sure everything goes

smoothly in production. In societies above the

EPLPLO society, the human race as a whole takes on risk (we will suffer if

production is low) so it is our responsibility to make sure nothing goes wrong.

In real-world situations, large groups of people are extremely poor at making

organizational decisions. (A common joke is an illustration of a tire swing

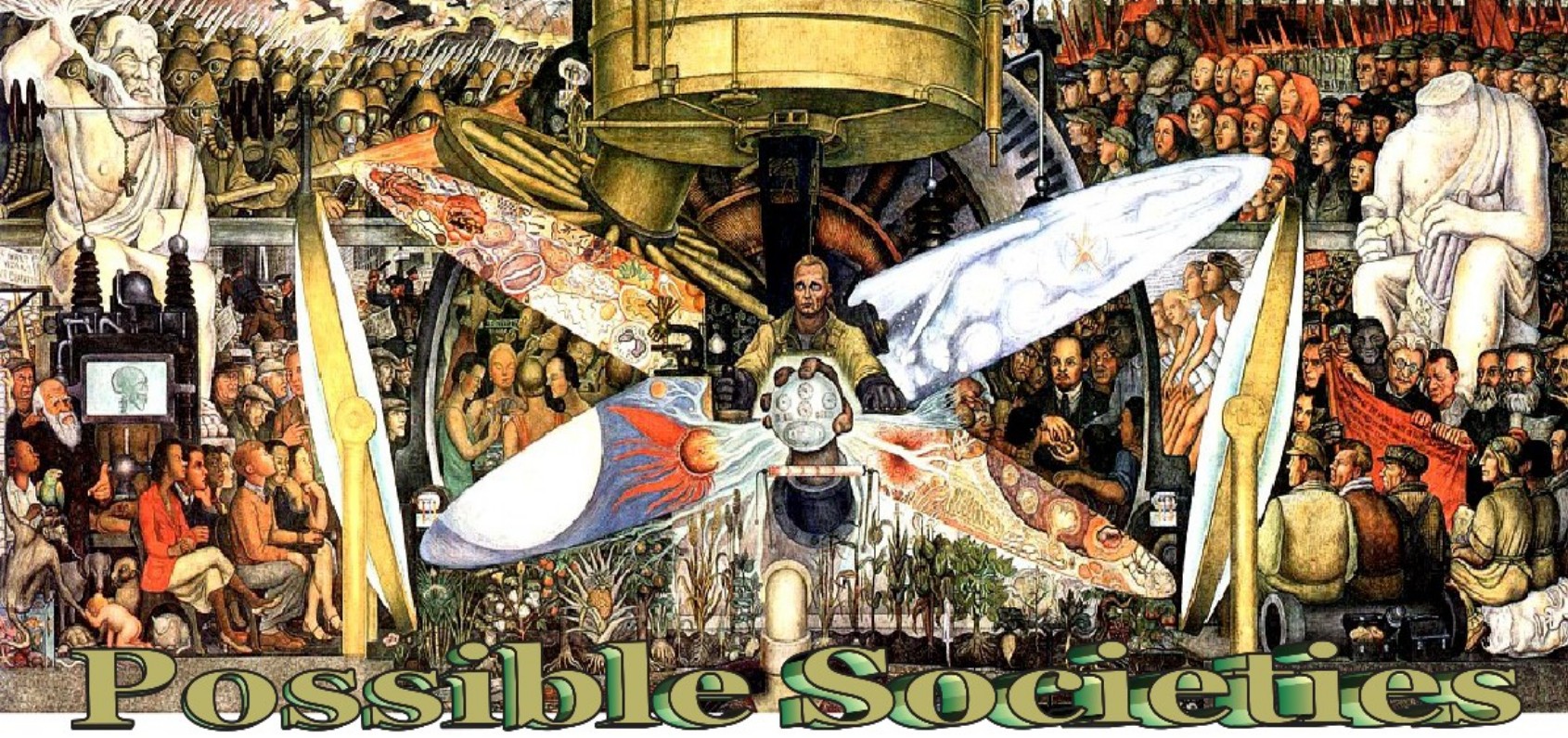

made a committee, see cartoon to right.) qqqq

Once the human race is absolved of risk, we have no reason to worry

about production decisions anymore. We don’t have to screen people who want to

control properties to make sure they will do a good job anymore: If we can’t be

hurt by them doing bad jobs, we

have no reason to care. (The people who take on risk and will be hurt by bad

managers will make sure the people who control property know their jobs; see

sections on risk management above.)

In

all societies below the EPLPLO system on the Road Map, the human race is

totally passive, with no need to involve itself in production decisions in any

way. All of the people who make these decisions are professionals, with their

own money on the line and their own skin in the game if something goes wrong.

Their interests, to avoid losing money, will coincide exactly with the

interests of the human race (making sure production never falls enough to

affect us).

3. The third difference involves constructive incentives. Societies before EPLPLO societies do not have constructive incentives: they do

not work in ways that make it possible for people to make money specifically on

improvement projects (buying leaseholds specifically to improve them, improving

the underlying properties, and then selling the leaseholds.)

All societies below the

EPLPLO system do have

constructive incentives: people who want to do nothing other than improve the

world can make money by doing this. In other words, people who have no interest

whatever in farming, but only want to improve

farms so they will produce more value (buy leaseholds, improve the

underlying properties, then sell the leaseholds) can make money doing this.

The EPLPLO system is the first system

we get to that has these constructive incentives. People in the past have shown

that some societies have incentives to make the world better, and compared

these incentives to an invisible hand, that pushes people to make the world

better. The EPLPLO system is the first place in our journey where this

‘invisible hand’ appears.

When

this ‘invisible hand’ first makes its appearance, it is week and feeble, like

the invisible hand of an infant. As you will see, the invisible hand will grow

stronger and more powerful, until it is an overwhelming force that leads to

progress and growth that can alter the basic realities of human existence.