Incentives are behavioral

motivations; they are pressures that push us to act certain

ways. Each incentive can be thought of

as a kind of invisible hand, pushing people to act certain ways. If you can make money doing something, you

will feel some sort of emotional pressure to do that thing, because you can use

the money to buy things that make your life better. The more money you can make, the stronger the incentives.

Part Five of this book goes into great detail about the different

incentives that can be parts of human societies. This issue is easier to explain if you understand a large number

of societies and can compare them. You

can see that some societies

have powerful incentives that push people to build, innovate, invent, create,

invest, manage risk, and do things that lead to the creation of value. Other societies weaker incentives to do

these same things. Some societies do

not have these incentives at all: there

are no natural rewards for activates that lead to progress and growth. Some societies actually punish people who do these things:

they work in ways that make the costs of improving greater than any potential

benefits to the decision makers. People

who try to improve the way the world works, or advance the state of human

knowledge, will find that they have to give up wealth and agree to accept a

lower quality of life and standard of living than they would have if they

didn’t do this.

This book uses the term ‘constructive incentives’ to refer to

incentives that push people to things that make the world a better place in

terms of the wealth or ‘things

of value’ it contains. Some societies

have constructive incentives. Some

societies do not have constructive incentives.

The Importance of Understanding the Difference between incentives that

push people to do things that harm the world and incentives that push them to

make the world better

If you take something with little or no value to humans and turn it

into something with enormous value, you have added value to he world and made

the world a better place.

If you take something with a lot of value and turn it into something

with little or no value, you have made the world a worse place.

Say that you start with clean, fresh air and run it through the engine

of a car. The air gets mixed with

fossil fuels that have been buried under the ground for billions of years and

are contaminated with dangerous heavy metals that were removed from the air by

the ‘fossil’ plants that degraded to make the fossil fuels. The oxygen and gasoline mixture is ignited

creating an explosion that alters the composition of the air many ways. The explosion pushes down a piston

generating energy; the piston then goes back up pushing the gaseous mixture

that is left out of the engine into the air.

The air coming out of the engine has many harmful products that were

not in the air when it went into the engine.

It has large amounts of carbon dioxide, a gas that insulates the

atmosphere holding in heat that warms the entire earth. It has carbon monoxide that is highly toxic

to humans and unburned bits of carbon that are corrosive and foul the air. The gasoline contains large amounts of

sulfur which burns with oxygen to create sulfur dioxide; this is a gas that

gets into the air where it gets sucked up into he clouds; the ultraviolet light

that hits the clouds turns this into sulfuric acid. When it rains, this acid gets everywhere. The acid concentration is low so it won’t

burn you immediately, but its effects are cumulative; you age and everything

that is susceptible to acid degrade faster.

The nitrogen that makes up 69% of the air has also been changed. Normally, nitrogen is safe, stable, and

inert. But the incredible pressures

that take place in the engine cause the nitrogen molecules to bond with oxygen

creating ‘oxides of nitrogen.’ These

pollutants are extremely powerful greenhouse gasses (more than 200 times as

dangerous as carbon dioxide) and stay in the atmosphere for years. Even when they degrade, they cause problems

because the degrade into nitric acid which is even more dangerous than sulfuric

acid.

Many scientists claim that the most dangerous toxins of all are the

heavy metals. All mammals are

incredibly sensitive to the many metals that are released when fossil fuels

burn. Mercury in the air make us all

stupider, literally: It interferes with

the way the brain processes information.

If you breathe air that contains mercury while pregnant, your child will

be stupider than if the mercury had not been there. There is a long list of heavy metals in all fossil fuels,

including lead, chromium cadmium, copper, and zinc. All are toxic to humans if ingested.

If people do things that start with clean, pure, healthy air, and turn

it into contemplated air, they take something with value and turn it into

something with less value. They reduce the amount of value in the world.

Humans can do a lot of things that harm the world and people in

it. In some cases, people can make

money (or get other things of value) doing things that ‘turn things with a lot

of value into things with less value.’ All societies where this happens have

incentives this book calls ‘destructive incentives.’ We have tools we can use to measure value. In the societies we inherited, people use

money for this. A great many people do

research to determine the money value of damage people do from various activities,

including war, resource extraction, and pollution; since we also know how much

money people make when they do these things, we can use mathematical tools to

determine whether or not destructive incentives exist in different societies

(some do not have them) and, if they exist, their relative strength on

different societies we can study.

Note: This part of the book doesn’t go over any of

this math, I just want to understand that it is possible to use objective tools

to determine the strength of destructive incentives. Part Five goes over these tools and shows how to do the math, for

those who are interested. Here, we will

simply go over pretty obvious relationships that exist between ‘making money’

and ‘harming the world’ in one particular type of society, one built on the

principle of territorial sovereignty. I

want to show you that these societies clearly have destructive incentives and

we don’t have to know any math to understand that they are extremely

strong: people can make fantastic amounts

of money doing things that destroy immense amounts of value.

It is possible to take things with great value and turn them into

things of little or no value. This book uses the term ‘destructive incentives’

to refer to incentives that reward destruction of value.

It is possible to do the opposite.

We can turn things with little or no value to humans into things that

are extremely valuable and very useful.

A good example involves smart phones.

Smart phones are built on technology that takes advantage of the

chemical properties of the element ‘silicon.’

The manufactures get the silicon to make these phones from ordinary dirt

and sand: the most abundant material on

the part of the earth we can get to (the crust) is silicon dioxide. This is what mountains are made of and what

the first 50 miles of the earth’s surface is made of. It is also called ‘sand’ and ‘rocks.’ It is possible to process ordinary sand in ways that remove the

silicon and process it into crystals which can be cut into very thin

sheets. By stacking these sheets a

special way, and printing the sheets with aluminum ink that will act as wires,

the silicon can be turned into electronic circuits that can do many things. They can process data, emit light (with

light emitting diodes), control whether light passes through a surface (with

liquid crystal displays), detect light (the CCD that is used as a camera on

your phone is a very versatile light detector) sense motion, determine which

way is up, and do thousands of other things, all of which your smart phone can

do.

All of the parts of the smart phone are made out of extremely common

materials that existed from the time the earth existed. Over the course of the last few generations,

extremely intelligent people have worked hard to figure out how to remove these

materials and turn them into the things that we now take for granted, smart

phones. The most important components

of the phone are made, literally, from sand.

If you have a 4 ounce smart phone, you are literally holding 4 ounces of

sand that has been modified into a different form.

The phone is a lot more useful than the sand it was made out of. By turning the sand into the phone, the

manufacturers have added value to the world.

They didn’t add any mass or elements: all of the elements in the phone existed millions of years before

the first humans arrived on the world.

They changed these elements to put them into a from that had more value. The phone can be used to talk to people

around the world, to take movies and record data, to play games, to watch the

news, to determine your location if you are lost, to map a route to wherever

you want to go, and to light your way through a dark room. It is a very useful product.

Since we have tools to measure the relative values, we can determine

how much value is added. (If the raw

materials that went into the phone can be purchased for 3 cents, and the

finished phone can be sold for $1,000, the manufacturer added value of $999.97

to the world.) If people can make

money with this process, they have incentives to do these things.

Different societies have different ‘incentives profiles.’ They have different mixtures and patterns of

incentives. We have seen that natural

law societies do not have the incentives that push toward progress and growth;

in fact, their natural forces tend to push against it, preventing progress and

causing loss of advances that have been made in the future. If we understand the details, we can

determine which societies have constructive incentives. We can determine the strength of incentives,

when they exist, and compare societies based on the strength of the incentives.

Again,

this part of the book will not go over any more than the most basic of

mathematical analysis. I only want you

to know that it is possible to do this analysis. If we do, we will have tools that we can use to compare human

societies objectively and scientifically.

We can determine which societies will have progress and which wont. We can determine which of two societies that

do have progress and growth will grow faster.

We can determine which changes could be made in societies that would

alter the rate of progress and growth.

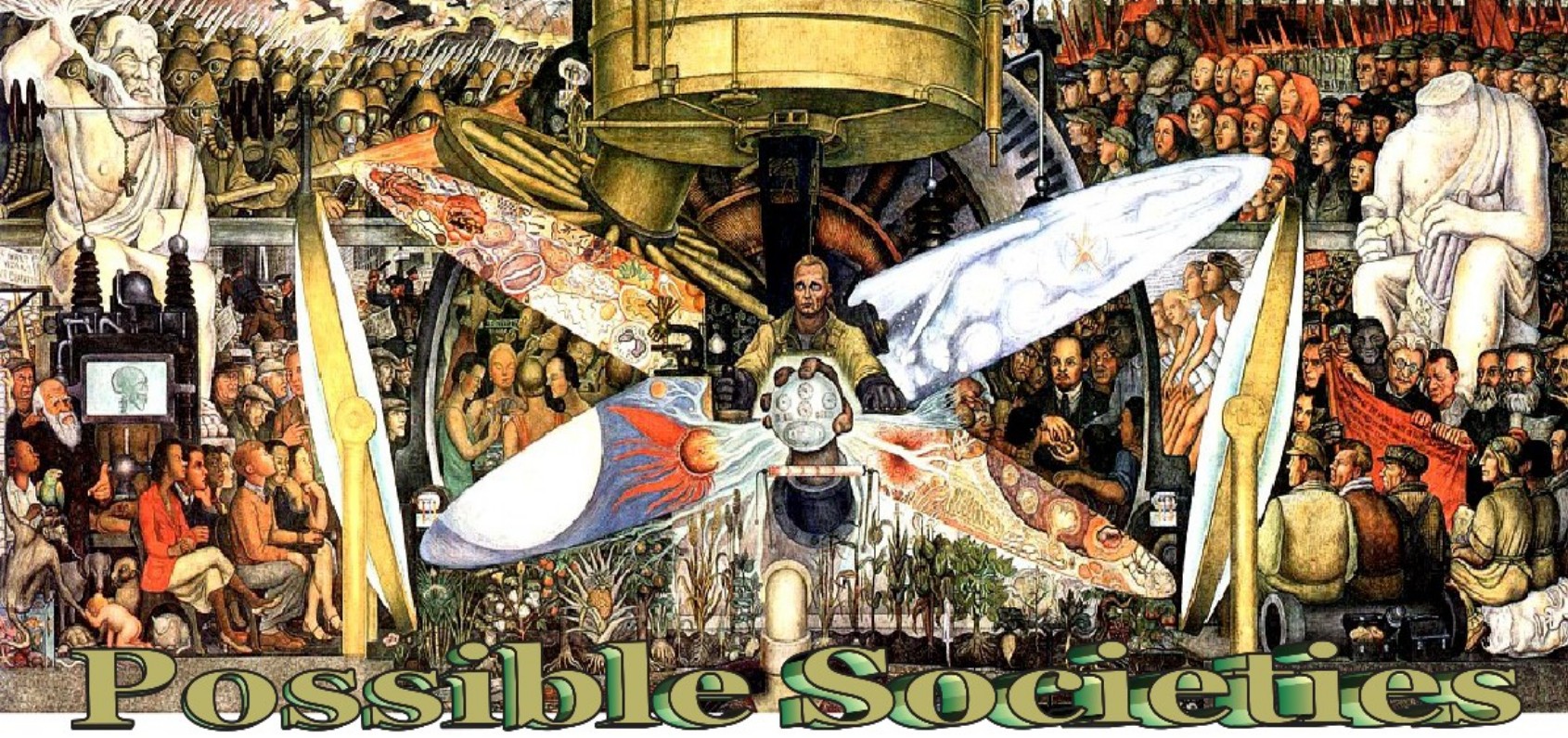

If

a group of people are in a position to form any kind of society they want (as

is our group in Pastland), they can decide exactly how they want their finished

societies to work. They can then look

through the possibilities of societies that are organized in some logical way

(that is what Part Five does) to see which has the incentive profile that is

most consistent with their requirements.

Then they can build that society.

This

part of the book is only designed to lay out the relationships so you can

understand them within the context of one specific type of society, a society

built on the principle of territorial sovereignty. I want you to be able to understand why these societies (which

are the societies we inherited) work the way they do. These societies have both

constructive incentives and destructive incentives. They have ‘invisible hands’ pushing us to do things that add

value and destroy value. You could say

there s a tug of war going on all the time in these societies, with some forces

pushing us toward destruction and others pushing us toward progress. We need to understand what is happening here

in order to understand the societies described in Part For, which only have the

constructive incentives and do not have the destructive incentives.

If we understand the strength of constructive incentives in different

societies, and understand the way people react to incentives, we understand

some important realities of existence for the human race, and for other beings

that are in the same category that are in a position to determine what kinds of

societies to build.

Societies without

constructive incentives will tend to be stagnant and not grow at all. Societies with weak constructive incentives

will advance slowly. Societies with

stronger constructive incentives will advance more rapidly. Some societies have constructive incentives

that are so strong that they actually negatively affect the quality of

life: people will feel such pressure to

find new and better ways to create value, and work so hard to do this, that

they will ignore their family, ignore their health, and literally work

themselves to death in an attempt to create value.

The same is true for destructive incentives. Some societies have very powerful incentives that push toward

destruction of value of all kinds. They

provide enormous rewards for war, the most destructive act within the

capability of thinking beings with physical needs wherever they are. They work in ways that allow people to get

very rich if the do things that harm the world, even if this harm is totally

unnecessary.

We

can make electricity by paying people to dig up fossil fuels and then burning

these fuels in massively expensive power plants. We can also make electricity

by setting silicon based solar panels into the sun and letting them turn the

energy of the light into electricity.

The destruction is not necessary:

the electricity can be made without it.

(I make all of my own electricity with solar, including the electricity

used to power my car.)

It

may seem strange that it would be more profitable to produce electricity using

the obviously expensive system (pay people to dig up fossil fuels and burn them

in a massively-expensive power plant) than it would be to use the cheapest a

and most abundant material on the planet (silicon dioxide, the main component

of solar panels) which will then produce electricity at no cost whenever the

sun is shining. We will see that in most societies, the solar system will

always be preferred and always be far more profitable. But there are some societies that have

strange features that reverse the natural relationships to make destructive

systems more profitable than non-destructive alternatives. We happen to have been born into societies

with these strange features. If we want

to understand why these societies work as they do, we really need to understand

the flows of value that create these incentives.

The actual details are so complex that I have decided to devote an

entire book to them. Anatomy of

Destruction explains the realities of destruction in a specific type of

society (one built on the principle of territorial sovereignty) in great

detail, using examples from the world around us. This book, Possible

Societies, deals with a different topic, the comparison of different

societies and Part Three is only designed to help you understand the basic

realities of societies built on territorial sovereignty.

We live in societies that have both

destructive incentives and constructive incentives. You could think of an incentive as an invisible hand that is

trying to pull the system in a certain direction. You could think of the interplay between destructive incentives

and constructive incentives in territorial sovereignty societies as like the

game of tug of war. The destructive

incentives are trying to pull us over a cliff into our own extinction. The constructive incentives are trying to

pull us toward a better future.

If we can understand that this tug of war is happening, we can

understand a lot of things about the societies around us that can’t really be

understood otherwise. For example, these

societies are highly unstable, with things called booms and busts, expansions

and contractions, depressions and recessions, inflations and hyperinflations,

ages of wisdom and ‘dark ages’ that can last many centuries. Why do these things happen? If we understand the interplay between

incentives, we can get some idea.

Destructive Incentives

If the foundational structures of a society work in ways that allow pep

to get wealth (to get rich) doing things that destroy value, those societies

have destructive incentives.

Territorial sovereignty societies reward destructive acts several

ways. Perhaps the most destructive

activity within the capability of thinking beings is the one that we casually

call ‘war.’ In Territorial sovereignty

societies, the world is divided into independent entities that own everything

inside their borders. They own the

wealth the land creates now, the wealth it will add in the future,

This section under construction.

Constructive Incentives

Some societies work in ways that naturally reward activities that can

lead to progress in technology and understanding of the universe. Some tie the right to get money or other

forms of wealth to behaviors that cause the world to create more value over time (where ‘value’ is

anything that humans may want or need or that can make life better for

humans.) Some tie the right to get

money or other forms of wealth to invention, discovery, and investment in

facilities that turn items of little or no real value to humans (sand, for

example) into items of great value to humankind (smart phones, for

example).

This book uses the term ‘constructive incentives’ to refer to

incentives that encourage the ‘creation of value’ and that encourage people to

do things to make the world a better place for the human race.

We have seen that natural law societies don’t have any inherent

structures that naturally reward constructive behaviors with money or other

things of real material value. This

doesn’t mean that no one will ever do anything constructive in a natural law

society: people often do things for

reasons that are unrelated to the right to get money or things of material

value for themselves. However, it means

there are no organized, directed forces that push toward progress and growth in

a consistent and predictable way.

people in natural law societies may make progress, from time to time, in

some areas. But the basic structures of

natural law societies don’t cause the progress to become institutionalized and

form a new base which can support further progress. (In fact, as we saw in the last chapter, natural law societies

work in ways that often cause a ‘reversion to primitiveness,’ where even great

achievements can simply fade into history and become lost forever, due to a

lack of investment.)

Without consistent incentives pushing for progress and growth, we would

expect natural law societies to be stagnant.

They may remain extremely primitive for incredibly long periods of time.

Societies built on sovereign ownability, however, clearly do have

incentives that encourage advancement of technology, growth in production,

invention, discovery, investment, risk management, and other behaviors that can

lead to more value existing on the planet that has these societies.

Territorial sovereignty societies have both destructive incentives and constructive incentives. People can get rich by destroying the

world. We know this: many of the world’s rich got their wealth

through conquest, rape of the environment, construction of tools of murder an

death. But we also see a class of rich

that got their wealth inventing, discovering, investing, and building

facilities that lead to devices that make the world better for the people who

have access to these devices.

We live in an amazing world.

You may be reading this on a smart phone, a tiny device that can

download entire books in a fraction of a second and display them on a screen

that you can tailor to your vision; it provides its own light so you don’t need

to go into the sun or to find a candle and flame to read it; in fact, you can

still read if you are blind because you can push a button and it will speak the

words aloud. You may be reading this in

a car that goes faster than any animal on earth can travel, or a jet that

travels into the upper atmosphere so it can go even faster; you may even be on

an orbiting platform that travels more than 28 times the speed of sound. If you don’t like reading books, you can

watch movies, either on the tiny screen of a phone or on a massive screen that

is wider than your field of view, with a resolution that is higher than your

eyes can detect, with the ability to push a button to stop time so you can

study a scene, and sound that shakes you and creates a feeling that is more

real than reality.

If you get sick, you can go to a doctor, get treated, and walk away

from problems that would have killed you just a few generations ago. If you are foolish and do something that

tears your body to pieces, surgeons can put you back together, with medications

that prevent suffering while your body heals.

If you are hungry, you don’t have to worry about what the part of the

world around you can produce: you can

go on Amazon and have items from anywhere on earth delivered to your door

within a few hours; you can eat ice cream on the hottest days and have baked

Alaska in a comfy kitchen in the middle of a blizzard.

Dark no longer bothers us: a

switch turns on light that is better than natural light for seeing the things

around us. Cold is banished by furnaces

and heat pumps. If the air gets stuffy,

push a button and the air conditioner comes on. If you want ice, push a different button and it comes out of the

machine into your cup. You don’t have

to wash dishes by rubbing sand onto them or wash clothes by beating them against

rocks: machines do it all for us.

Smart Phones

I like to use smart phones as an example of ‘creation of value’ because

it illustrates the process of value creation very well: smart phones obviously have a great deal

more value than the raw materials they are made out of.

The main components of the phone are made of silicon dioxide and

aluminum. These are, coincidently, the

most common and abundant materials on the part of the earth we can get to, call

the ‘crust.’ The crust is 87% silicon

dioxide and 8.3% aluminum. If you want

to find small particles of the ‘crust’ of the earth, go to a beach: the action of the waves beats rocks against

other rocks, chipping off pieces and rubbing them against other pieces,

essentially ‘sandblasting’ them, making them smaller and smaller. This has been happening for billions of

years. They end up a sand. This is the starting material for a smart

phone.

The glass is made directly out of sand. You can make glass yourself out of sand, by heating it to a very

high temperature. It turns into liquid

and this liquid hardens into glass. Of

course, modern glass makers have refined this process a great deal and the

glass they make is of much higher quality than the glass you can make yourself,

but the basic idea is the same.

The electronic parts are made of silicon, which comes from silicon

dioxide. Sand is 87% silicon

dioxide. The processor, touch censors,

the CCD camera and other light sensors, and the LED lighting system that

illuminates the phone are made of silicon.

The glass is made of silicon dioxide.

The other parts, including the case and wiring, are mostly

aluminum. Sand is 8.3% aluminum. This means that if you are holding a smart phone in your hand, you are basically

holding a handful of sand that has been processed.

Various people figured out how to take sand and turn it into extra-hard

glass, processors, CCD sensors, touch sensors and casing materials, aluminum

‘ink’ to print onto a board that acts as a wiring harness to hook it all

together. These parts went to assembly

lines and were put together. At the end

of this process, the hardware of the phones is complete but it is not yet

‘smart.’ To make it smart, it has to be

hooked up to a computer that will install the software and run diagnostic

tests. It is now a ‘smart’ phone. You can then put in a ‘sim card’ and start

using it anywhere in the world. You can

take or watch a video, check the weather, check your email, buy things and have

them delivered to you, book a flight to China, use its GPS and compass to

determine exactly where you are, play games, find instruction manuals for just

about anything you own, and even make a phone calls.

My phone was made by Apple, a company formed by Steve Jobs, Steve

Wozniak, and Ronald Wayne. The company

didn’t create the matter that

the phone is made of. The matter (the

silicon, aluminum, and other elements) existed long before Apple corporation

was formed. Apple basically organized

and built systems that took things that already existed but were in a form

without any significant value to humans (mostly sand), then processed these raw

materials, turned them into parts, assembled the parts into usable devices, and

employed thousands of programmers around the world creating software to make

the phones more useful.

Although a ‘company’ made the phone, real flesh and blood humans were

behind everything the company did.

The three men listed above went to government agencies in countries all

around the world and filed documents to create

the corporation. The corporation was

then a kind of artificial person, an entity that could make deals, sign

contracts, buy and own land, and enter into business arrangements as if it were

a real human being. The creators then

arranged to get financing to cover the cost of doing research about how to

actually build the devices they wanted to build. They hired thousands of people to design and engineer factories

that would take ordinary raw materials that are all around us and turn them

into parts that could then be put together to make computing devices, including

smart phones. They bought land in

hundreds of locations all around the world for the facilities they would need

to build the parts, assemble them, design and install the software, test the

products, package them, and get them to consumers. They hired attorneys to help them get the permissions from local

authorities to build these facilities.

They began construction on many different kinds of facilities, each of

which had a different function, with plans for it all to come together to

create the finished products and make them available to consumers all around

the world.

This was a mammoth undertaking.

Some of the factories required hundreds of millions of dollars in

materials and required millions of man-hours to build. They had experts coordinating

everything. Many of these people worked

so hard on the project that they didn’t have time for their families, for

enjoyment of nature, or for anything other than their work.

The first facilities they built worked well, but not as well as they

wanted them to work. They hired experts

to go over every single detail so they could find improvements; they then made

these improvements, often being forced to abandon facilities that didn’t work

well enough to suit them. In the end,

they wound up with a network of buildings that basically worked like this: at one end, loaders poured sand, rocks, and

other basic items of the earth that contained the required raw materials into

hoppers.

The materials through networks of machines, factories, and other

facilities until, at the other end of the process, finished, programmed,

ready-to-use smart phones in attractive packages came off the line, complete

with everything needed to make them work.

Most of the work was done by machines and the people involved in the

process are trying hard to eliminate any need for human hardship or toil on the

way. If they had their way, they would

have a single switch that they could flip that would cause automated machines

to start gathering sand and other materials in places where these materials

were fantastically abundant; the machines would then process them into packaged

and programmed smart phones which would come out of the network of machines

with no human effort needed for anything that happened.

A great many people worked very, very hard for many years to make all

this work. They took great risks: no one even knew if the first devices Apple

made (computers) were going to work at all:

It had never been tried. Still,

the founders used their own money and worked tirelessly, month after month, to

go through every detail. Early

investors poured hundreds of millions of dollars into the company, all without

knowing for certain that the devices would work or that, if they did, people

would be interested in using them enough to pay for them. They poured wealth, time, skill, talent,

effort into the project.

Why did people do these things?

You don’t have to think very long to answer

this question:

They did it for money.

The people who did these things went from

being ordinary people to being the world’s super rich. Their wealth brought them great power that

included the power to control the destiny of millions of people. As of the summer 2022, the company they

built is worth roughly $2,626,640,000,000,000 ($2.62 trillion).

How much is this?

The largest country in the world, Russia,

has a GDP of $1.774 trillion. This

means that if you bought everything produced in Russia, including all food,

fuel; if you rented all buildings, offices, and homes; if you purchased all

electricity at market prices, if you hired everyone who works to wash cars,

repair washing machines, and made jewelry, cut hair, and did anything whatever,

paying them the same amount they made in 2021, you would have to spend $1.774

trillion. The people who own the Apple

company could easily afford this. In

fact, after paying for everything produced in the largest country on earth in

an entire year, they would have enough money left over to buy all farmland in

the country often referred to as the ‘breadbasket of the world,’ the

Ukraine.

The

average price for farmland in Ukraine in the summer of 2022 $1,300 per hectare;

the country contains 42,000,000 hectare of farmland, so you would need $546

billion to buy it all. If you owned

the Apple company, you could sell it, use some of the money to buy these

things, and have more than a trillion dollars left over.

And, even after all that, you would have

enough left over to fully fund the following governments for a year: New Zealand, Colombia, Malaysia, Bangladesh,

Hungary, Vietnam, and Iran,

The people who did all of the things to make

these devices were very well compensated.

They got fantastic amounts of money for the things they did.

Before they even started planning, they knew

it was possible for people to incredible fortunes doing the things they wanted

to do. They could read about the vast

fortunes made in the history books.

Henry Ford came up with a new way of manufacturing cars and built the

massive Ford Motor Company; when he died, his estate was worth $188 billion in

2022 dollars. Ford built the first

affordable cars and showed that cars weren’t just luxuries for the very

rich: even working class people could

afford them. Andrew Carnegie built

massive steel plants. People had been

making steel for thousands of years, but it had been made in tiny backyard

facilities that could only produce small amounts; because everything was done

by hand, costs were very high. Because

of Carnegie, steel became so cheap that Ford could afford to make cars out of

it and sell them profitably at a price of only $260 each (this was the price of

his early model T cars). When Carnegie

sold his steel company in 1901, he got the $310 billion in 2022 dollars. John D. Rockefeller cornered the market on

oil. He bought entire fields and then

built transport facilities and refineries to turn it into useful fuels; he sold

the fuels through networks of service stations all over the world. When he died, his estate was worth more

than $400 billion in 2022 dollars.

George Westinghouse and Thomas Edison created our electric

infrastructure. Bell created the

telephone system. Marconi created

broadcast systems all around the world.

Watt created the steam engine.

The Wright Brothers made the first practical aircraft.

These people put together incredible

networks of facilities that make the wonderful things that make life easy and

comfortable for us today. Because of

them, the world can produce enough food and get it to the right places to feed

8 billion people. They all had

incentives to do the things they did:

they got rich doing them.

The people who created the smart phone knew

it was possible. It had been done.

The people who formed Apple created the

network of facilities that invented new products and organized everything. They got paid for this two different ways:

First, they got something called

‘dividends.’ The company pays out about

$1 per share on each of its 16.86 billion shares, so it pays out about $16.86

billion a year to shareholders.

Second, they got something called ‘capital

gains.’ They paid a certain amount for

the ownership interest they have in the company. If the company can make more things of value to the human race,

and sell them, the value of their ownership interest goes up. The amount they make from this depends on

the exact time they bought in. People

who ‘bought in’ at the very beginning (including those who formed the company)

and held their ownership interests for long periods of time made billions. Collectively, the owners made trillions of

dollars.

They created a network of facilities that

made things that made life better for humans.

They had powerful incentives to do this. They made so much money from their venture that money became meaningless

to them. They earned their way into a

kind of freedom that most people can only dream of.

Where Does the Money Come From?

The people who created this network of facilities got paid two

different ways.

First, they got something called ‘dividends’ of their stock. If a company is making money (selling items

for more than it pays in costs) the shareholders may vote (through their

elected ‘directors’) to pay out money to them to pass some of this money on to

the owners. These payments are called ‘dividends.’

Second, the market value of the shares they own can go up. If a company is growing and expanding its capability to make money, people will

pay more money for the stock in the company.

If you had bought a billion shares of Apple when it was still a fairly

small company with small revenues (say in 2015, when the split adjusted shares

were selling for $20 each), and held it until January of 2022 (when shares were

selling for $180 each) you would have made $160 billion.

Of the two benefits, the greatest, by far, is the benefit people can

get from buying low (or creating

a company, meaning buying for nothing at all) and selling high. In the same period, the company paid out a

total of $5.60 in dividends. If you

owned 1 billion shares, you would have gotten $5.6 billion in dividends and

made $160 billion, or more than 30 times more money, on the increase in the

value of ownership of the company.

Later, we will examine the amounts of money people can make by buying

and owning rights to things that we may call the ‘means of production’ in

different societies. Obviously, people

can’t make anything buying and owning these things in natural law societies,

because at least one thing that is necessary for all production, land, is not

ownable.

However, societies that don’t accept any ownability of the means of production are extreme societies (just as are

societies that accept all rights are ownable).

It doesn’t have to be all or nothing.

It is possible for a group of people in a position to form any kind of

society they want to decide they want certain specific rights to use the world

to be buyable and ownable. For example,

a group in such a position may decided they want to find a kind of ownership

that will allow the wealth that flows from the land that has nothing to do with

improvements or changes made by the current owner to NOT be ownable, but will

allow people to buy and sell rights to streams of value that don’t exist yet,

but which could exist if improvements were made.

The

people buying Apple between 2014 and 2022 were paying mostly for things they

expected to happen in the future. If

Apple had been an old and mature company with no real growth progress, its

earnings would have justified a price of perhaps $2 per share. You could say that about 1/10th

of the share price reflected the ownership of the ‘rights to the money that the

company was already making.’ The

majority of the price reflected the value of owning the rights to create and

implement new strategies and build and sell new devices and services that

rested on Apples existing platform.

What if there was some way to use markets to ‘subtract out’ the rights

to benefit from future innovation, invention, and discovery? A group of people in a position to form any

kind of system they wanted may decide to make the rights to future growth ownable, but not make

the rights to free cash flows that already existed when the people involved

(say the buyers of stock) became involved.

These people would buy and own the right to all benefits of their own

innovation and invention. But the

rights to get the ‘basic’ flows of cash the world generates would not be owned

or ownable.

We will see that there are many forms of ownership. It is possible to use a form of ownership

called ‘leasehold ownership’ (which already exists and is being used in many

places) to create a mix of ‘rights that are ownable’ and ‘rights that are not

ownable. We will see that we can adjust

a single variable to change the ratio by infinitely tiny increments, creating a

system that has the exact mix of ‘rights that are ownable’ and ‘rights that are

not ownable’ to bring the incentives we want.

The system discussed in Part Three is built on a very specific form of

leasehold which, as we will see, is already used in many places and already

extremely well understood. This system

transfers ownership of all rights due to the improvements, innovation,

invention, or other creative behaviors of the people who own these rights (own

something called a ‘leasehold title’ to the property or corporation) to the

owners, while leaving all of the rest of the value the world creates to be

unowned and unownable (in the same way all

value created by nature is unowned and unownable in natural law

societies.) This will lead to an intermediate system; it is not a natural law

society (because it allows ownability of rights to nature and the means of

production) and it is not a sovereignty based society either (because it does

not allow ownability of sovereign rights by any entity). It is somewhere between a natural law and a

sovereignty based society.

After

we look at this one system, we will understand three societies; two extreme

systems and one intermediate system. We

can then ‘fill in the gaps’ and come to understand the other intermediate

systems. This will allow us to compare

them all by comparing the different incentives created by the different

systems.

We

will see that there are only two things that can change about societies of

thinking beings with physical needs:

1. The way they interact with the physical

world that provides their needs, and

2. They way they interact with other members of

their own species.

Total

ownership (sovereign ownership) is a ‘way of interacting with the world: we can divide it into territories and fight

over who owns everything. Total

non-ownership is also a way to interact with the world: People in natural law societies interacted

with the world this way. Each different

partial ownership system is built on a specific way of interacting with the world.

Since the world provides all our food and everything else we need to

keep us alive, the system we choose for a ‘way to interact with the world’

determines what people have to do to meet their physical needs. This means it determines the incentives that are part of

societies.

After we have decided how we, the members of the human race, will

interact with the planet we live on, we have built the foundation for a society.

We may then decide what we want to build on that foundation and work out

the other variables. Obviously, if we

are building on a specific foundation (say a system that divides the world into

territories that fight over sovereignty for each square inch of the world) we

have different options for social

variables than if we have a system that has an entirely different relationship

with the world (say a system where no one owns any part of the world).

Social variables are the details

of society. The relationship with the

world is the foundation that

these variables will rest on. We can’t

really start building the social variables until we know what kind of

foundation we want to start with. (For

example, if we decide we want the world divided into territories that fight

over total rights to land, we are limited to societies that have governments

capable of fighting wars; these become the foundational social variables. Other societies, that don’t have these

powerful forces pushing for well-organized, well-funded, all out battles to

doom, have options for social variables that sovereignty based societies do not

have.)

If we want to understand the incentives that are inherent in different

societies, we need to understand flows of value. To make this easier, this book represents all flows of value with

flows of money. They all use money and,

in each system, one unit of money will be called a ‘dollar’ and will represent

the ability to buy one pound of rice.

The people who bought Apple shares in 2014 and sold them in 2022 wound

up with billions of dollars. Imagine

you had done what was suggested above, and made $160 billion from the

transaction. This money spends exactly

the same as money that people made working for $1 per hour on rice farms in

Indonesia, China, and India. These farm

workers made a total of $16,000 from eight years of work, eight hours a day, 50

weeks a year. You made $160 billion, or

10 million times the amount the workers made, without lifting a hand.

It is easy to see where their

money comes from: rice was sold for a

high price and they were paid out of the proceeds.

But where did your

money come from? If we want to

understand how societies work, we have to understand these things.

Unfortunately, the societies we inherited (territorial sovereignty

societies) are the incredibly complex. They have mind-boggling complexity and it

clearly doesn’t make sense to start an explanation of a complex topic (like

‘what determines the market values of the means of production like the Pastland

Farm and the Apple company?) in the context of the most complex society possible.

Starting with the next chapter, we will examine a society that is a

little more complicated than a natural law society, but far, far, simpler than

the societies we inherited. This will

allow you to see how this process works in a system that is simple enough to

understand how it works.